Floyd County housing needs assessment shows seniors top list

By Bob Steenson, bsteenson@charlescitypress.com

A recent housing needs assessment for Floyd County and Nashua doesn’t contain a lot of surprises, but it does put the situation in perspective and point to some ways to focus future efforts.

The preliminary results of the housing study were presented last week. The report, by Maxfield Research & Consulting of Golden Valley, Minnesota, contains a list of “key takeaways,” as well as priorities.

“The No. 1 takeaway was the demand for senior housing,” said Tim Fox, executive director of the Charles City Area Development Corp., which ordered the study.

“It pretty much ran true to form, because we’ve seen enough of the other county’s housing needs assessments to know that we’re facing, essentially, the same problems as every other rural community in Iowa,” Fox said.

The study was based on data collected from the fourth quarter of 2018 to the first quarter of 2019, and divided the county into three housing “submarkets” — the Charles City submarket, which is most of the east half of Floyd County except for the Nashua area; the West submarket, which is the entire west half of the county; and the Nashua submarket, the southeast corner of Floyd County.

The study shows a steady decline in population in the county since 1950, and predicts a continued decline in each of the three submarket areas through 2025.

Despite that, some parts of the population are growing, the report says.

Baby boomers — ages 55 to 74 — account for 27% of the county population, and the group of people age 65 and older is expected to account for 8% of the population growth in the next five years.

There are few senior housing projects in Floyd County, with the majority of units in Charles City and a vacancy rate below 4%.

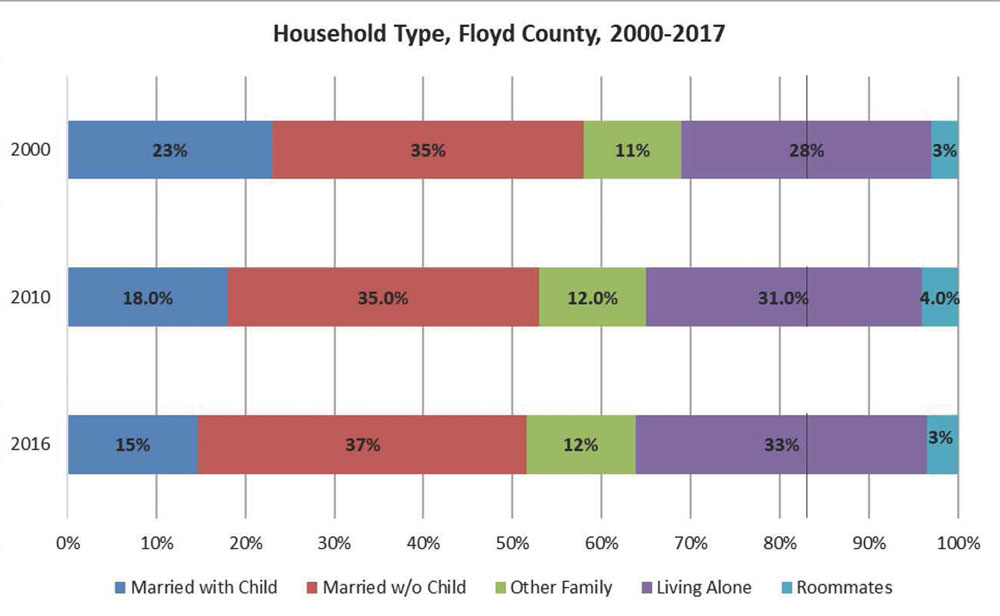

The number of married couples with children is declining, while the number of married couples without children and the number of people living alone — both groups including a growing number of seniors — is increasing.

That trend — fewer people living in each housing unit — is driving a demand for more housing even while the population falls, the report shows.

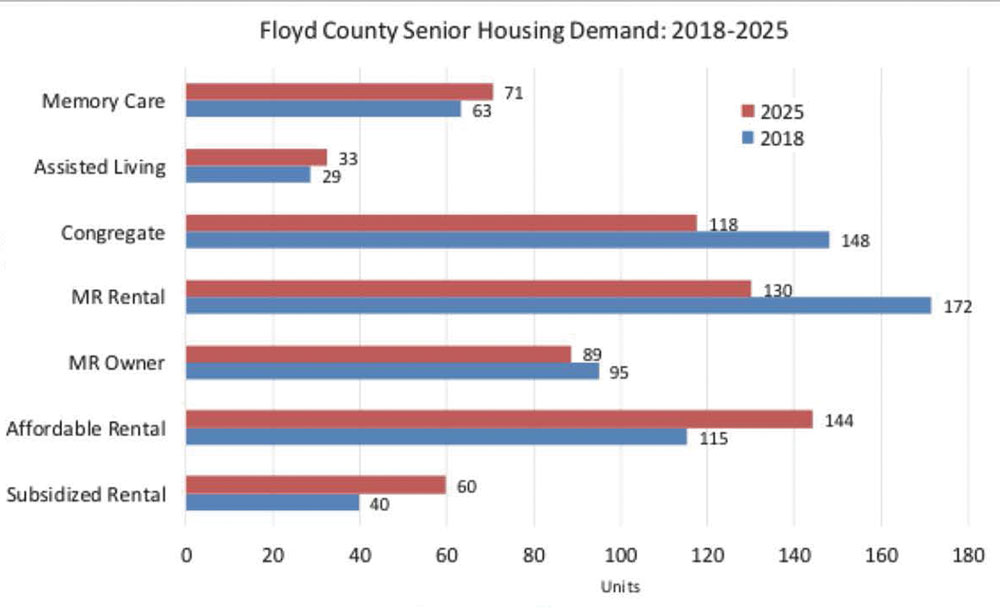

There will be a demand for more than 1,050 additional housing units in the county and Nashua through 2025, including almost two-thirds of them — almost 650 units — just for seniors.

The highest demand for senior housing is for independent living housing.

Average home sale prices have peaked in the last two years, and real estate agents are optimistic on the market overall, the report says.

The study forecasts a demand for 103 additional single family homes, with the strongest demand for entry-level homes. But it acknowledges it is difficult to build entry-level single family homes given the development costs.

“It’s virtually impossible to a do a single family subdivision in rural Iowa because it just doesn’t cash flow, especially with the cost of infrastructure,” Fox said.

“You don’t have the tax base to fund any of the infrastructure because you don’t have a commitment to build ‘X’ number of houses, so you can’t rely on a fixed amount of tax dollars to pay for any infrastructure,” he said.

“That’s where it gets kind of dicy,” Fox said. “It’s going to require government subsidy somewhere along the line.”

Fox said one of the answers is to build new homes on existing lots.

“I think one of the big impetus you’re going to see in rural Iowa is in fill lots,” he said. “Towns get serious about their code enforcement, purchase and tear down dilapidated homes and then fit a new house on that lot.

“That requires some government cooperation as far as setbacks and that kind of thing, but that really is going to be the most cost-effective means to getting any new housing,” Fox said. “The difference is that you already have all the infrastructure there so the cost of the house is cheaper. And you don’t have the land costs.”

Fox said the Area Development Corp. will likely work with Charles City in identifying houses that need to be demolished to make room for new homes.

“The city needs to take care of them and destroy them and then we’ll go from there,” he said. “I would like to say there are a lot of state programs to help with that, or federal programs to help with that endeavor, but there really aren’t.”

The area will also need additional rental units, the study says, specifically mentioning the development of projects such as McQuillen Place, a multi-unit residential and commercial development on Charles City’s Main Street that is about 90% complete, but which is currently mired in foreclosure and bankruptcy battles.

“The rental housing market is strong, but lacking supply,” the report says.

Overall, of all the properties interviewed, there is less than a 1% vacancy rate. That includes a 1.2% vacancy rate in market rate apartments and a 0% vacancy rate in “affordable” or subsidized apartments.

That compares to the overall rental vacancy rate in Mason City of 4.5%, the study says.

The average rental rate for market rate apartments in Floyd County is $325 to $435 for a one-bedroom unit, and $330 to $475 for a two-bedroom apartment, the report says. The average rent per square foot is 63 cents per month.

That compares to an average of $395 to $550 for one-bedroom apartments in Mason City and $495 to $629 for two-bedroom apartments, for an average of 88 cents per square foot.

In other words, rents for similar-sized units in Mason City are almost 40 percent higher than in Floyd County, the report says.

The rents collected in Floyd County make apartment projects difficult to cash flow, the report said. New construction requires an average per-square-foot rent of $1.03 a month to break even.

Fox said the results of the housing needs assessment will be discussed among many of the joint meetings that groups have, including among city, county, school district, Chamber of Commerce, Community Revitalization and others.

The housing needs assessment cost $25,000, which was paid by Floyd County through an old housing assistance fund that had about $30,000 left in it but that was no longer being used for its original purpose.

The final report, almost 200 pages that will include much more precise demographic details, is expected today (Wednesday), Fox said.

“It was pretty progressive of the Floyd County supervisors to finance a housing needs assessment that included Nashua,” Fox said. “I was really pleased to see that.”

The “key takeaways” from the report are:

• Declining population for decades, but flat over next decade.

• Population is aging and will impact alternative housing types.

• Low 3.6% unemployment rate and job exporter (importer in Charles City).

• Tight rental market (below 1% vacancy).

• Soaring senior housing demand, but lack of product.

• Home prices at record highs, but lack of inventory for entry and middle-market.

• Lack of “maintenance-free” for-sale housing; single-family dominated.

• New single family construction caters to move-up and build-to-suite market.

• Lot supply dwindling in Charles City submarket.

• Difficulty cash-flowing new housing developments.

• Promote public-private partnerships and housing programs.

• Development financial incentives likely needed.

“Priorities” listed are:

• Promote development of rental housing stock, including McQuillen Place.

• Court senior housing developers, freeing up existing housing stock.

• Encourage association-maintained and single-level living housing types.

• Lot development in the Charles City submarket.

• Implement “one-stop shop” housing resources.

• Aging housing stock; sponsor housing programs.

• Maintain zoning code that permits alternative housing types (i.e. twin homes, etc.)

• Promote private-public-partnerships to stimulate housing markets.

• Jobs, jobs, jobs… especially higher wage jobs.

• Update housing action plan regularly.

Social Share