Survey indicates more evidence of Midwest economic slowdown

Survey indicates more evidence of Midwest economic slowdown

Manufacturing activity drops, especially for those linked globally

OMAHA, Neb. (AP) — The latest monthly survey of supply managers in nine Midwest and Plains states shows more evidence of a slowdown in that region’s economy, according to a report released Tuesday.

The overall Mid-America Business Conditions Index fell to 40.7 last month from 41.9 in October, 47.7 in September and 49.6 in August. The regional index was affected by a reduction in manufacturing activity, especially for producers linked to international markets.

“Since our survey oversamples manufacturing firms, it is not surprising that our overall index has weakened significantly for states and industries heavily dependent on agriculture and energy, which are being hammered by a strong U.S. dollar,” said Creighton University professor Ernie Goss, who oversees the survey. But he added that the weakness has yet to spill into the broader regional economy.

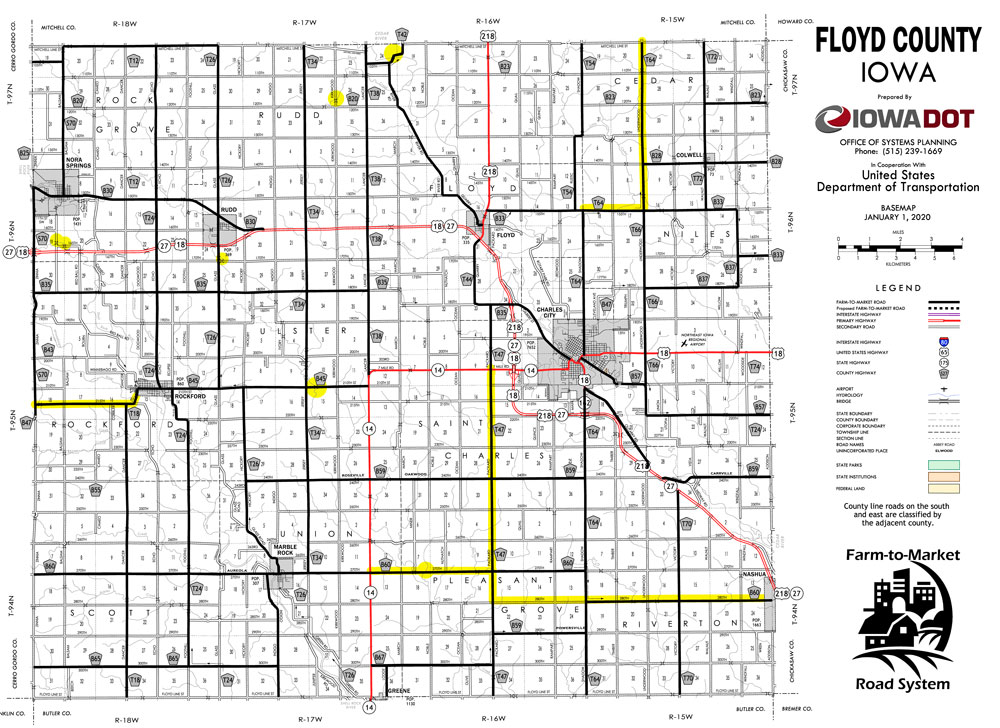

The survey results are compiled into a collection of indexes ranging from zero to 100. Survey organizers say any score above 50 suggests economic growth, and below 50 a decline. The survey covers Arkansas, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, Oklahoma and South Dakota.

The Iowa overall index declined to 42.3 last month from 44.2 in October. Components of the index were new orders at 35.5, production or sales at 37.6, delivery lead time at 54.4, employment at 43.3 and inventories at 40.7. Federal data show that over the past 12 months, Iowa lost 1,300 manufacturing jobs. Our surveys of supply managers in the state indicate this trend will continue into the first quarter of 2016,” said Goss.

The regional employment gauge slumped to 41.7 in November from 42.3 in October, indicating job losses for the manufacturing sector and the sector for value-added services, which includes warehousing and utilities.

“Over the past year, the region has lost approximately 1.1 percent of its manufacturing jobs. This pace of job loss is roughly twice that of U.S. manufacturing, which is likewise shedding jobs,” Goss said. Areas heavily dependent on manufacturing are experiencing the largest losses.

Economic optimism for the next six months, as captured by the November business confidence index, sank to 41.2 from 42.3 in October.

“Falling agriculture and energy commodity prices, along with global economic uncertainty, pushed supply managers’ expectations of future economic conditions lower for the month,” Goss said. Over the past 12 months, farm products and energy prices have fallen by 13.6 percent and 22.9 percent, respectively.

Social Share