North Dakota lawmakers vote down 6 bills to limit carbon capture

By Jeff Beach, Iowa Capital Dispatch

Members of the North Dakota House on Friday showed their commitment to pipelines and energy development, voting down six bills that would have taxed or put guard rails on the emerging carbon capture industry.

Rep. Jeremy Olson, R-Arnegard, summarized his opposition to three of the bills by saying, “North Dakota doesn’t need a CO2 sin tax.”

Opponents of the bills voiced support of carbon capture pipelines, in particular for their potential to extend the productivity of North Dakota oil wells through enhanced oil recovery. In enhanced oil recovery, gas is pumped into the well to help force out more oil.

Carbon dioxide pipelines also come with risks, bill supporters noted. Carbon dioxide is a hazardous material and a rupture is potentially fatal.

“Accidents happen all the time,” said Rep. Dennis Nehring, R-Williston, a veteran of the oil and gas industry.

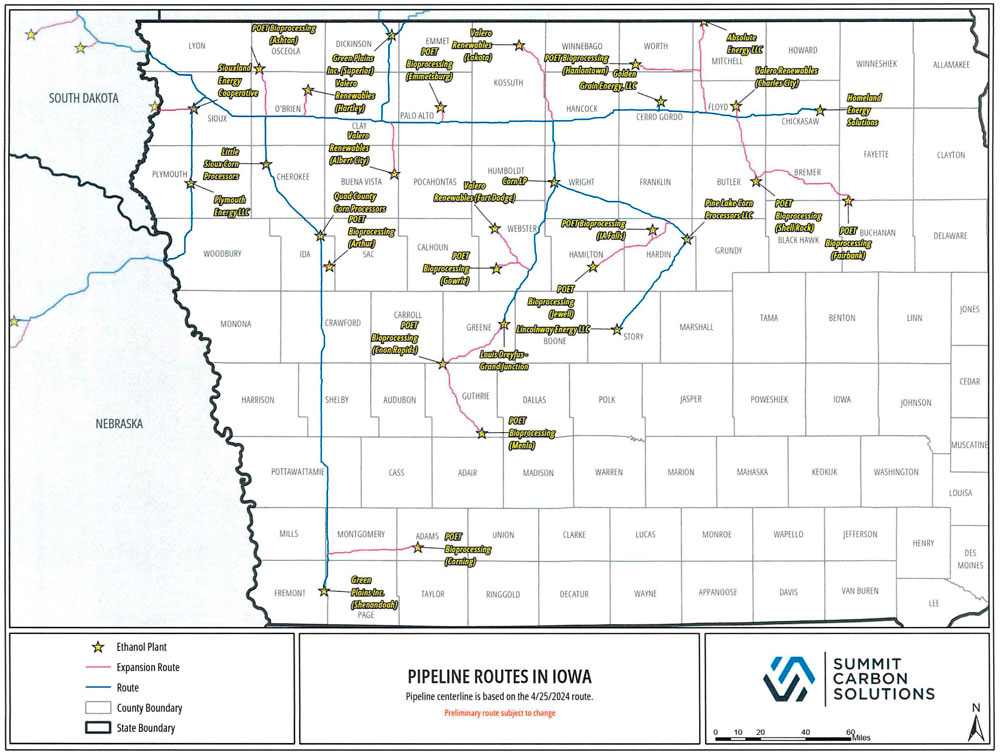

While not named directly by legislators, many of the bills and much of the discussion circulated around Summit Carbon Solutions, the developer of a five-state pipeline network that will capture carbon dioxide from ethanol plants and transport it to western North Dakota for permanent underground storage.

While Summit’s plan doesn’t include gas for enhanced oil recovery, legislators said North Dakota should not inhibit carbon pipeline development for the oil and gas industry, or for the coal and ethanol industries.

Rep. SuAnn Olson, R-Baldwin, the sponsor of four of the bills, said she tried to focus on carbon pipelines that were only for storage, not for industrial use.

Opponents argued that ethanol and coal plants need carbon capture to lower their carbon scores and stay economically viable.

While enhanced oil recovery is not yet widely used in North Dakota, a study by the state tax commissioner projects North Dakota could see another $2.9 billion to $9 billion in oil tax revenue over 10 years if oil companies begin using the technology.

“The oil industry is the golden goose of this state. And I think we want to be prepared for when those times come where the pressures within the Bakken diminish, and we’re going to need to go to the enhanced oil recovery piece,” Rep. Craig Headland, R-Montpelier, said.

Some of the bills attempted to limit the ability of carbon pipeline developers to use eminent domain, a legal proceeding that could force landowners to provide a property easement for pipeline construction. One way to hinder the use of eminent domain would be stripping carbon pipelines of common carrier status.

The bills defeated Friday were:

• House Bill 1292, removing common carrier status for carbon pipelines.

• House Bill 1414, denying use eminent domain for carbon dioxide pipelines and revoking common carrier status for carbon pipelines.

• House Bill 1295, eliminating tax exemptions for carbon pipelines.

• House Bill 1573, imposing a fee on carbon dioxide transportation to create a disaster fund.

• House Bill 1210, specifying that carbon dioxide pipeline companies are liable for damages within a 25-mile zone if a pipeline leaks or ruptures and providing protections against pipeline operator’s bankruptcy.

• House Bill 1574, which would have placed a two-year moratorium on direct air capture of carbon dioxide in North Dakota.

Meanwhile, on Thursday, the House Energy and Natural Resources Committee supported House Concurrent Resolution 3016, citing the benefits of enhanced oil recovery and encouraging the state and federal governments to support the development of carbon capture technology and utilization of carbon dioxide.

A vote by the full Nebraska House is to come.

— This story was originally published by North Dakota Monitor, which is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity. North Dakota Monitor maintains editorial independence. Contact Editor Amy Dalrymple for questions: info@northdakotamonitor.com.

Social Share